GROW THE SAN DIEGO WAY · JP THEBERGE AND BILL TIPPETS · FRIDAY, AUG. 23, 2019

The Voice of San Diego published an article last year, San Diego County Will Be Short of Housing Even If Everything Planned Gets Built. It referred to recently announced preliminary Regional Growth Forecast figures that differed wildly from the forecast developed just 4 years ago. They showed that despite a lower population and lower employment than was projected in the last forecast, our housing need somehow increased by a whopping 56%, conveniently above the General Plan capacity of the County. These numbers could be used to help make the case for building more sprawl-oriented projects in the rural areas of the County.

While the media and everyday citizens, having been accustomed to alarmist headlines about housing, did not question the numbers nor the headline, people in the planning community were flabbergasted. Naturally, Grow the San Diego Way was intrigued and concerned that the numbers defied common sense and logic. We dug deeper to find out why.

To be clear, under every possible analysis, it is abundantly clear that San Diego has not achieved its level of needed housing, particularly in the lower and moderate income levels. We need to build a lot more housing that is affordable to moderate and lower income San Diegans. That is not in question. What is in question is a non-transparent process whereby forecasts are inflated unnecessarily via a flawed methodology and with possible input from players who are riven with conflicts of interest. Updated: 10/1/19 for clarity.

SANDAG creates a new regional growth forecast for future planning including housing, population, and employment every four years. As part of that process, they take the most recent population projections provided by the state and plug it into a model which, among other things, spits out how many houses will be needed by 2050. All things being equal, a decrease in the 2050 projected population should yield a decrease in the need for housing. The population figures are provided by the State of California Department of Finance (DOF), as required by law. This year, the DOF lowered their population projections for the San Diego region for 2050 by about 70,000 people (versus the last time this analysis was conducted). Plugging that number into the housing model should yield about 25,000 fewer houses needed in 2050 than were originally projected. And in fact, about a year into the process, SANDAG’s new forecast was well within that range. However, something unusual happened during the process and SANDAG’s housing forecast jumped upward by more than 180,000 houses. Let’s explore how that happened.

1

4,069,000

population decreased

3,997,000

All things being equal, if there are fewer people, there should also be fewer housing units projected. About 25,000 fewer houses. The need for housing should go down.

2

housing need should decrease

+326,000

+301,000

3

instead housing increased 56%

+326,000

+509,000

FIGURE 1: This chart was included in the Technical Working Group presentation delivered by Ms. Cortes. (originally provided to Expert Review Panel; obtained through Public Records Act request). The red lines are the scenarios SANDAG derived from the earlier, larger expert review panel. The solid red line is the lower scenario (SANDAG 1). The dotted red line is the high scenario (SANDAG 2). The gray horizontal line is the “buildout” of all general plan capacities across all the jurisdictions. Note that both SANDAG scenarios are at least 100,000 houses lower than the full build-out scenario, indicating that we have enough capacity in our general plans to absorb the projected housing. Notes in bubble added by Grow the San Diego Way from PRA documents.

FIGURE 2: This chart (click to expand) was included in the Technical Working Group presentation delivered by Ms. Cortes to update on the Regional Growth Forecast on March 26. Note that the housing units jumped from a range of 1.375M to 1.450M in February 2018 to 1.702M in March. These numbers were never discussed or shown to the panel.

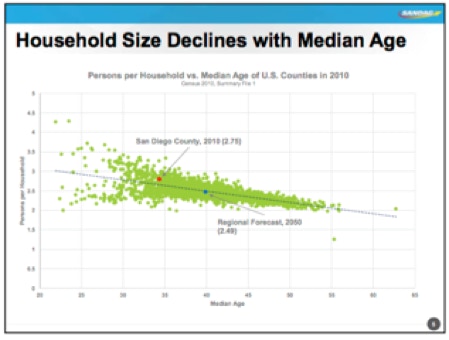

FIGURE 3: This chart (click to expand) from the Technical Working Group presentation attempts to show that household size is correlated to median age. This was never shown to the expert review panel demographer and (as shown below) is methodologically unsound from a demographics standpoint.

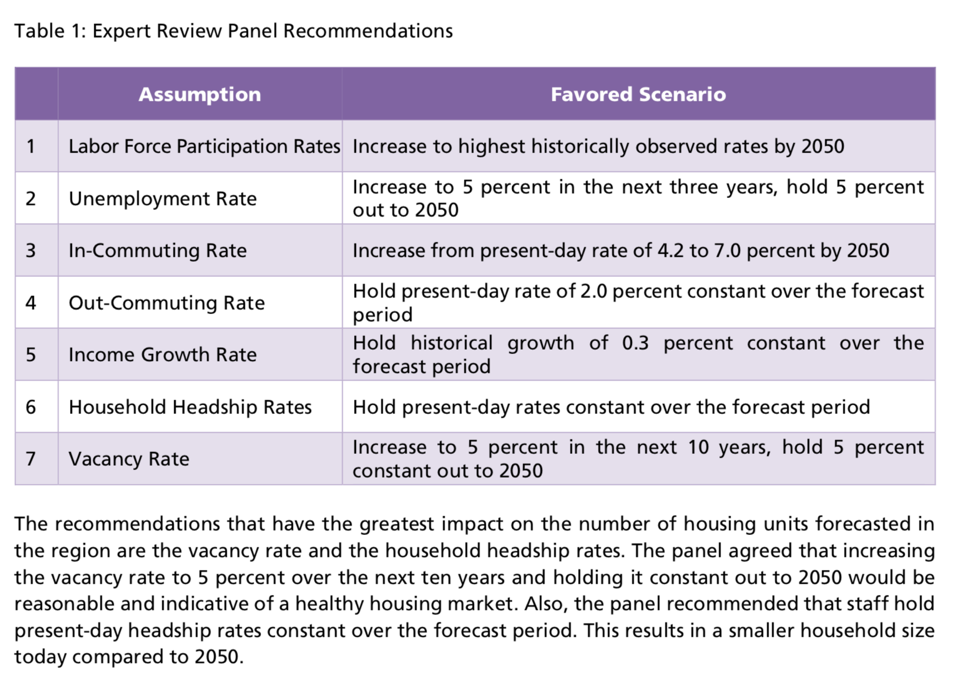

For approximately the first year during the development process, the team seemed to be on the right track. From March 2017 to February 8, 2018, the team had come up with two possible, realistic scenarios, a low and and high estimate. This was the result of 4 public meetings of the regional planning committee and technical working group and input from a twelve-person expert review panel that included a diverse group of experts including demographers, economists and industry experts. Both scenarios were fairly close to the last forecast which would make sense, since the inputs were similar (and in fact the population and jobs inputs were lower than the last forecast). The most conservative scenario used a demographically reasonable “headship rate” assumption (based on rate of household formation) that would remain constant through 2050. This model yielded a number (1.45 million units) that was slightly higher than the earlier Series 13 forecast. An alternative, lower, scenario yielded 1.375 million units which is lower than the Series 13 forecast (see Figure 1, above).

A week later, on February 14, 2018 the second expert review panel met. This was the smaller panel of 5 experts of which 2 were building industry consultants from the same firm. Subsequent to that expert review panel, a meeting of the Technical Working Group was convened (on March 26, 2018, Item 3) and findings from the panel were presented. It inexplicably added 330,000 units to the forecast from the previous scenarios SANDAG had presented. It introduced an entirely new household variable based on a nationwide regression analysis, not on localized demographics. To estimate the future housing units for 2050, they used population growth, vacancy rates, average age of population and a flawed estimate of “persons per household” (PPH) to arrive at a figure for how many houses would be built by 2050. Using those inputs, they arrived at 509,000 additional units that would need to be built by 2050 which was a substantial increase from both Series 13 and from their initial stab at the forecast, and of course, makes a case that we suddenly do not have enough capacity in our regional General Plans to absorb the projected housing need.

Assumptions used AFTER the convening of the February 2018 panel:

a) population: The figure for projected population, comes courtesy of the Department of Finance (and regional planning agencies like SANDAG are required by state law to use this figure for regional planning). DOF’s projection was lower than it was four years ago.

b) vacancy rate: Rather than predict a realistic vacancy rate based on historical figures (2-3%), SANDAG chose to pick a “healthy” best case scenario of 5%. This obviously increases the housing forecast for 2050 because it assumes that the housing market will eventually resemble that of the rest of the United States and will be a “healthy” market. This is a dubious assumption, but its impact is not as significant as some of the other assumptions. In fact, at a later meeting the number was reduced to 4%.

c) second homes and vacation rentals: Here, SANDAG assumes that these will not increase significantly because they do not have enough reliable data to adjust the figure. They assumed about 57,000 houses will be unavailable to residents.

d) household size (persons per household): this last assumption is the one that would have the greatest impact on housing need and it is also one of the most difficult variables to project – so hard that the Department of Finance’s own Demographic Research Unit will not make projections much more than 20 years past the recent Census.

Source: Agenda - Regional Planning Committee - May 4, 2018, Item 18-05-4

The assumption that would have the greatest impact on housing numbers is the persons per household (PPH) figure. It is also the one least likely to yield accuracy for 2050. To obtain persons per household in 2016 is easy; you divide the total number of residents by the total number of occupied houses and that gives you PPH. The number SANDAG used for 2016 is 2.76. It is close enough, though the DOF figure for PPH in 2016 is 2.81, if we’re seeking the most accuracy

(http://www.dof.ca.gov/Forecasting/Demographics/Estimates/E-5/).

3,039,937

2.76

1,103,030

For currently available data, the persons per household (PPH) data is easy to calculate. It is derived from existing data on population and households, so it is reasonably accurate. The problem starts when you try to project into the future. PPH is a very difficult number to project because there are many factors that can affect it: household trends (multigenerational households, boomerang children), ethnicity (Hispanics have larger households, for example), delayed household formation, fertility rates and age distribution (older folks tend to have smaller households). In fact, it is so difficult to project that the Department of Finance (the entity charged with maintaining and updating projections on population and demographics every year) refuses to speculate.

In an email exchange, Walter Schwarm, Director of the California State Data Center for the Department of Finance, told Grow the San Diego Way:

In essence, he is saying that there is no data that supports such a low PPH figure. And in a subsequent email, one of his colleagues, Bill Schooling, at the Department of Finance reiterated this:

.

.

With the state’s top demographers stating that forecasting “persons per household” is not tenable even 12 years from now, we ask how was SANDAG able to project PPH out to 2050? A reasonable degree of accuracy is required when forecasting out to 2050. Why? Because important long term plans by the local jurisdictions use SANDAG’s regional forecast to project everything from traffic, water, housing and even tax revenue.

In its analysis, SANDAG looked at all 3,142 United States counties from the 2010 US Census and plotted them on a cluster chart by PPH and by median age (chart below). This created a linear trend line that showing that, on a nationwide basis (in 2010), counties with a higher median age also had a lower household size (PPH). In other words, if looking at all U.S. counties, higher median age seems to correlate to smaller household sizes; as folks get older, their children move out, etc. This linear trend is represented by the equation y = -0.0289x + 3.6465 where y is the persons per household and x is the median age. If the median age (x) is 40, then PPH (y) is 2.49. However, demographers we’ve spoken with (including the sole demographer on the panel) noted that this is a highly inaccurate way to forecast persons per household and is, in fact, bad science.

Since San Diego’s population is projected to age by 2050 (to a median age of 40, according to DOF), SANDAG attempted to correlate median age with average household size. Essentially, SANDAG plotted a linear trend line that showed that, on a nationwide basis, counties that are older tend to have fewer people per household. Based on this linear trend, counties with an average age of 40 have about 2.49 people per household. So, if US counties in 2010 with a median age of 40 have a household size of 2.49, SANDAG’s assumption is that San Diego will follow exactly the same pattern. The below interactive chart is a recreation of the chart SANDAG presented; you can click on the data points representing each county for more information.

San Diego County

2050 (2.49)

San Diego County

2010 (2.75)

There are numerous significant flaws to this analysis that demographers we interviewed noted and further, this demographic analysis was conducted without input from one of the top demographers in the state who, incidentally, was also a member of the panel. He told us that some of the reviewers were not provided information about the persons per household assumption that was used in the Series 14 projections at either of their meetings:

In fact, from the February 2018 convening of the second panel to the March 26 meeting of the Technical Working Group, there was a substantial change in the projected housing number and, crucially, key members of the panel were not consulted, despite their requests for more information. As mentioned previously, as of February 2018, the preliminary housing forecast scenarios were between 1.375 million to 1.45 million housing units, which is in line with the previous forecast (Series 13) of 1.4 million units. In March, the number inexplicably jumped to 1.7 million and used a flawed and unscientific methodology to justify the jump. Again, not all experts were consulted on this change and the demographer in the group, Ethan Sharygin, asked SANDAG to remove his name from the document.

Nationwide demographics vs. local dynamics: Using “total U.S. counties” as the basis to project future household size (PPH) in California is counter to basic principles of demographics. The household composition, ethnicity and age distribution for counties across the US in 2010 vary so widely and diverge so considerably from California counties that making conclusions from that data set is highly flawed from the start. For example, in 2010, older Counties also happen to have a much larger White population and lower population overall. Franklin County, Indiana, with a median age of exactly 40 is 99% White. Contrast that with San Diego County which is 45.5% White and 33.9% Hispanic in 2017. Projecting out to 2050, San Diego County residents will average 40 years of age but the County will also be over 40% Hispanic. Why does that matter? Because Hispanics, on average, have larger households. How much larger? Almost a whole person larger. In many Latino cultures, multigenerational households are not only more common but they are culturally desirable (grandparents helping raise the grandchildren, adults taking care of their senior parents, etc.). According to 2017 Census data, Hispanics have 3.25 PPH. Non-Hispanics have 2.43 PPH. This fact did not escape two elected officials at the April 2018 Regional Planning Committee meeting, John Aguilera of Vista and Kristine Alessio of La Mesa who raised doubts about such a low household size given the ethnic and cultural makeup of their communities. So, using a correlation of all US counties to project San Diego household sizes in 2050 is not just inexact science, it is irresponsible. A seminal paper in demographics noted that:

Grow the San Diego Way took the exact same dataset that SANDAG used to make this correlation, but focused it exclusively on California counties. While the same methodological flaws exist (using median age as explained below, and the disparate counties) it still yields a much higher PPH (2.63 to be exact) which mostly erases the additional housing numbers.

.

Irrelevance of Median Age: One independent demographer we spoke with also raised the point that median age is absolutely irrelevant to the persons per household metric because it depends on the distribution of the age cohort that makes up that median. In fact, demographers never use median age in analyses on household size because it doesn’t take into account the overall distribution of ages across the population. They call it “age structure” usually depicted as a “population pyramid.”

.

.

.

.

For example, a County with the median age of 40, like Wilson County, Texas (see chart, above), could have a concentration of residents clustered around the median age (lots of middle age folks with older children in the home) or like Rock Island County, IL, it could have people bunched up at the ends of the spectrum, e.g. younger families (larger household sizes) and many senior households (empty nesters). Both counties average 40 years of age, but the PPH number is quite different, depending on the “shape” of the distribution. The former has a higher HH size (2.82) while the latter has a lower HH size (2.34). The median age remains the same, however. That is why demographers do not use median age and instead use age distribution, gender and ethnicity to look at household composition trends. Using median age to determine future household size is not only inaccurate it violates basic principles of demographics.

This is very important because this variable contributes the most to the housing forecast for 2050. A drop in PPH from 2.75 to 2.49 adds more than 150,000 more houses as there are fewer people per household.

different meetings, different assumptions, same end result?

What is most concerning about the inaccuracy of this Regional Growth Forecast is that there was much inconsistency and lack of transparency in how the final housing number was derived. After the last convening of the much touted expert review panel (February 2018), the preliminary forecast was presented to different audiences numerous times both at SANDAG and to the general public. In each meeting, a different set of assumptions was used, yet the end number (509,000 additional houses) remained the same. This gives the impression that the end number was pre-ordained and the variables were adjusted to arrive at that number. The most damning evidence of this was a presentation given at the North County Housing Summit (San Diego North Economic Development Council) that showed not only a different PPH number but also a different vacancy rate and yet the end result was exactly the same: 509,000 households. Here’s are review of the various ways that SANDAG has presented the findings:

March 26, 2018, Technical Working Group, Item 3: link

SANDAG staffers, Rachel Cortes and Coleen Clementson

.

.

.

April 6, 2018: SANDAG Regional Planning Committee, Item 4: link

Coleen Clementson and Ray Major

.

.

.

May 7, 2018: SANDAG Regional Planning Committee, Item 4: link

“Muggs” Stoll and Ray Major, basically presents the same numbers as in March, with the low-ball PPH number.

July 19, 2018: North County Housing Summit, sponsored by the SD North Economic Development Council: link to PowerPoint deck

Jim Miller on behalf of Ray Major, this presentation shows a completely different set of numbers for PPH and for vacancy rate than what has been shown in previous presentations. Yet, the end result is exactly the same: 509,000 houses. This presentation raises significant questions:

No explanation is given for the change of persons per household to 2.54 from the earlier figures of 2.49. Given the original trend line equation that SANDAG used earlier to calculate 2.49 PPH (y = -0.0289x + 3.6465 where y is the persons per household and x is the median age), a PPH of 2.56 would yield an average age of 37.6 (not 40) which would not be consistent with the original regression analysis SANDAG developed. Since the Board of Directors voted to lower the vacancy rate assumption to 4% in June, one should expect a decrease in the housing forecasted for 2050 and the overall number would go down. Instead, what appears to have happened is that someone at SANDAG chose to adjust the persons-per-household number to account for that drop in vacancy rate such that the final number, 1.7 million, would remain the same. There is no regression or trend line that indicates that 2.56 is a valid number. This is the clearest evidence to date that the final number of 509,000 additional housing units needed was preordained at some point following the expert review panel in February and that variables have been fabricated in order to justify that figure, which conveniently, is above the “full cumulative buildout” of all the regional General Plans in San Diego County. Essentially, the number makes the case that the housing prescribed in our General Plans will not be enough to accommodate the projected growth in housing.

Wilson County, TX (median age 40, PPH 2.82).

Rock Island County, IL (median age 40 PPH 2.34).

San Diego County

2050 (2.63)

San Diego County

2010 (2.75)

As our region suffers from a housing affordability crisis, it is essential we have reasonably accurate data to make projections. Exaggerating or obfuscating our housing need does not help solve the problem and can make it seem even more intractable than it is. When a problem is intractable, the public and decision-makers could give up on common sense solutions or they could implement extreme measures that could create other planning related problems in our region, but importantly, an inaccurate forecast affects ALL long range planning not just for housing.

These growth forecasts help regional planners make a case for allocating resources and setting policy on everything from transit, water supply, infrastructure, health, transportation, climate change, revenue and housing in all the jurisdictions. Knowing how many houses will be needed by 2050 helps us set our climate action goals (as housing helps determine vehicle miles traveled and greenhouse gases). It helps the County Water Authority estimate revenue and water consumption and correspondingly, establish infrastructure needs and estimated usage. In fact, the County Water Authority is in the process of developing their next long range planning goals and they make reference to the preliminary Series 14 numbers we are talking about here (p. 151 and 152 at the following link). If the forecast for housing jumps significantly, it has huge implications on their own planning process, budgets, supply and ultimately water rates for the entire County. They are about to spend half a million dollars on this plan and, if the inputs are inaccurate, their long range plans will be inaccurate which could cost millions or even billions of dollars to taxpayers.

In addition to transportation, revenue and water planning, this number establishes how much housing needs to be built every year to achieve the objective for 2050. A higher number in 2050 means we need to build more houses every year than previously projected. This has the effect of making a crisis that is already bad appear to be worse and possibly intractable. It also forces jurisdictions to attempt to build more houses than are necessary to meet that need.

But most importantly, this housing number was inflated just enough to make it appear that the existing general plans of San Diego County would not be enough to accommodate all the housing they were projecting which helps make the argument that we need to disregard the General Plan of San Diego that the building industry has been so disdainful of. With 10 general plan amendments planned for this year alone and another 10 on the way, they are well on their way to dismantling the smart plan for growth that we spent $18 million and 13 years developing. This forecast will help make their case.

Already, this preliminary Regional Growth Forecast (not yet finalized) has been used by members of the panel itself to sway decision-makers and the media in the conversation on land use and housing including the aforementioned article in Voice of San Diego.

More recently, the City of Santee recently spent $40K hiring Gary London (who was on the above-mentioned expert review panel) to provide analysis on a citizen’s initiative known as “the Santee General Plan Protection Initiative” (Save our Santee). Unsurprisingly, the report found that the city would lose millions in potential revenue on account of this initiative. The report relied, in part, on the preliminary Regional Growth Forecast that Mr. London himself had a hand in devising. Without this flawed figure, Mr. London’s case would have been much harder (and likely, impossible) to make. The Santee initiative (and others like it) is seen as a threat to the building industry because it requires that any major general plan amendment be voted on by citizens of the jurisdiction. With the exaggerated Regional Growth Forecast that Mr. London had a hand in creating, they were able to make their case whereas a more accurate (and lower number) would not have. This study will play an important role when the initiative goes on the ballot and opponents (including Mr. London’s industry clients who oppose these types of initiatives) will try to convince voters that it will harm the city.

In summary

At Grow the San Diego Way, we believe there is a housing affordability problem and that we need to build more housing, particularly in the moderate and lower income categories. We also believe that there needs to be a balanced conversation on housing and that in order to have that conversation, the data we use needs to be reasonably accurate. When data is flawed or, worse, manipulated, even if it is to tell an important story (we need housing) it causes the public to lose trust in the institutions that are supposed to help us make good decisions. It also makes a difficult problem seem intractable.

We hope that SANDAG’s new Executive Director, Hasan Ikhrata, will take a look at these figures and how they were derived and send the team back to the drawing board to come up with a more accurate number. You can email him here if you want to voice your opinion about this flawed forecast.

For a PDF version of the white paper, you can click here.